Blockchain Adoption: Will Corporates Take the Plunge?

This is part 2 of blockchain adoption in the enterprise, originally published on BostInno, analyzes the barriers for blockchain and what to expect from corporate buyers. For more on Bitcoin vs. blockchain, balancing risk with potential, check out part 1.

Corporations are still in the preliminary phases of exploring blockchain technology, contrary to headlines hyping the technology’s potential, and advances. Financial institutions are most interested as buyers of the technology, and are exploring dozens of use cases with varying degrees of traction. However, most corporate blockchain exploration is happening under a shroud of secrecy and decisions are kept under a tight lid, so the actual progress of corporate use cases remains largely unclear. Because corporations’ generic public comments (mostly around theoretical impact) do not represent corporate blockchain adoption, we’re providing our take with four serious considerations around adoption.

Early Experimentation

One can investigate blockchain interest in two ways: reviewing blockchain-as-a-service (BaaS) customers, and deciphering business development activity by consortia like R3, Hyperledger, Project Bletchley, and Paxos (previously ItBit). U.S. based corporations are cognizant of the regulatory environment and as a result almost exclusively look into the permissions space, also referred to as private blockchains, that would replace expensive and complicated systems.

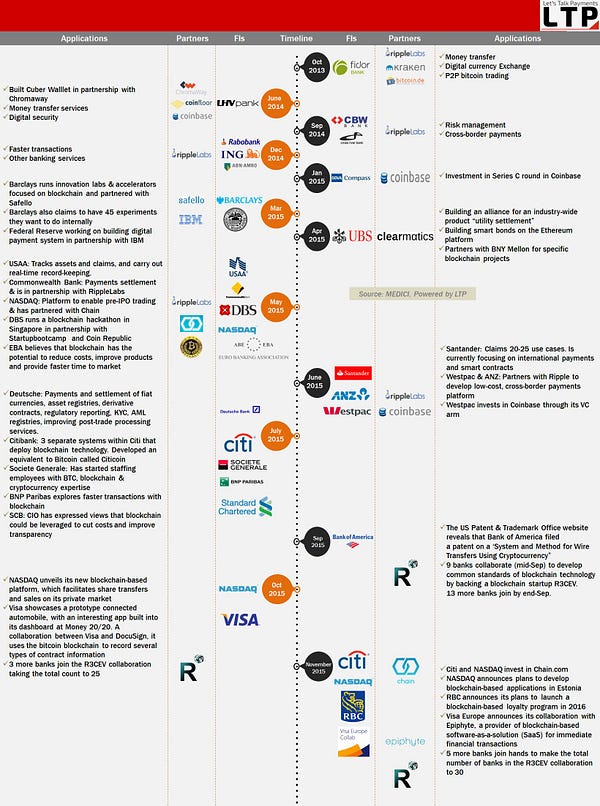

BaaS customers and consortia members are predominantly U.S. banks, while the list is growing and R3 recently added newcomers like China Merchant Bank and insurance behemoth, Metlife. Let’s Talk Payments covers the history of financial institution involvement in the pictured infographic.

R3 is receiving the most traction in the consortia world and currently has two main tracks for corporate customers: Blockchain Development Initiative with around 50 banks and the other is Reference Data Management pilots with about a dozen banks. As the head of innovation controlling a moderate budget, it makes sense to invest $250,000 as an entrance fee to exploreR3’s offerings.

Other consortia include Linux Foundation’s Hyperledger, which is in development phase, and open sources its platform for enterprises to contribute code. Hyperledger focuses on bridging blockchain based distributed ledgers to business transactions- Intel, Accenture and JP Morgan have joined as members. Another consortium to consider is Project Bletchley, which Microsoft released in June. Paxos, formerly ItBit (focused on OTC trading services) recently made a pivot into the private blockchain space, specifically to gold settlements. Consortia efforts come in many forms; the ‘Big Four’ accounting firms are even exploring their own blockchain consortium.

BaaS providers like Blockstack, Chain, and Multi-chain represent another wave of companies exploring blockchain implementation: Blockstack, Chain, and Multi-chain. BaaS adoption (and momentum) is even less transparent than consortia, where players like Chain keep their relationship details close to the chest. A number of companies have announced partnerships with Chain, but beyond instances similar to Nasdaq’s interest in using Chain for issuing shares in pre-IPO companies, progress and general involvement are not clear.

Beyond BaaS and consortia, some corporates are exploring hybrid (permissioned & permissionless) systems like Ripple. Ripple plans to sell banks XRP, which is its currency for liquidity and will offer Ripple Connect to hopefully alleviate costs and increase system speed.

Four Considerations for Corporate Adoption

We examined existing frameworks for how enterprises adopt new technologies and concluded that blockchain adoption warrants a different set of considerations. Here, we highlight the four focus areas that large corporations should consider before and during exploration phase:

1. Delivering on promise: cost savings, security

It seems like a Blockchain for X world in which Blockchain is the hammer, and everything is a nail. In early 2016, Jeremy Drane from PwC (now with Libra) said“there are only a small number of industry companies that can deliver solutions built on the technology — the industry is not as diverse as you’d hope.” Blockchain applications must meet the buyer, market, and system demands. As a rule of thumb, corporate buyers will not switch systems unless they see a 10x improvement in performance in new solution.

For context, VisaNet, Visa’s transaction processing system averages 2,000 transactions per second, with capacity to reach 56,000 transactions per second; compare this to Bitcoin at seven transactions per second, according to “On Scaling Decentralized Blockchains”. Ethereum’s system is faster than Bitcoin’s, but is not ready to replace VisaNet or comparable systems.

Changing systems is complicated. Financial institutions rely on on-premise systems that have been in play for decades, known for their security, but also their inability for data sharing (intra and interbank). Hyperledger’s Donna Dillenberger said “to ensure that blockchain is truly enterprise-ready for different verticals and different applications with different rules, more security and compliance issues must be firmly addressed…it’s technically challenging to add the needed security and compliance layers, as well as new sophisticated features, to blockchain to optimize it for enterprise use. Here at IBM it took many months to do the work thus far. So adapting it to many different use cases and applications takes a while.”

Takeaway

A meaningful percentage of ‘blockchain’ use cases will fail to gain traction for various reasons (security, upkeep, unrealistic expectations) in the current exploratory climate. Migration costs will become more tangible, and corporations will be more defined about their blockchain interest — and, it’s not unreasonable to estimate that this exploratory phase could last half a decade. As corporates refine their view on distributed ledger technology, it’s a win-win for FI’s and entrepreneurs because the blockchain movement is drawing hyper intelligent folks to ‘unsexy’ business problems.

2. Corporate politics/ internal buy-in

“I don’t want to be the guy who misses out, but I also don’t want to stick my neck out to far to be fired”. This sentiment is a common trend amongst corporate blockchain folks — being the blockchain champion within a large and complex organization is not easy, balancing the media’s hype fest with real business solutions.

As a large corporation, it’s difficult to innovate, and pressure for results often leads to misalignment between executives and blockchain champions. Without citing a reason, UBS and its blockchain chief parted ways in recent months.

Others, like IBM, realize there will be failure, so recruiting blockchain talent and creating a forward thinking culture has been the computing giant’s strategy. The company will create a new unit called Watson Financial Services to encompass Watson, cloud, and all blockchain-related offerings and strategy, and will be led by Bridget van Kralingen, IBM’s senior VP of global banking services and Mark Foster, formerly from Accenture.

Takeaway

Corporate innovation groups need influence to pilot and expand use cases, paired with sufficient senior management buy-in, patience, and budget resources. Exploration will take more than the $250,000 R3 entrance fee to understand if a blockchain solution ‘works’.

3. Regulatory roadblocks/ concerns

Regulation around Bitcoin has progressed the way we might’ve expected: slowly. Slow-moving governing bodies are keeping corporates at bay, and reporting regulations outlined in Dodd Frank and Europe’s equivalent, EMIR create friction in linking capital markets and blockchain technology — leading to risk in adopting blockchain technology even steeper.

In the U.S., corporates are almost exclusively exploring private (permissioned) blockchains due to restrictive wording in Dodd Frank around reporting. Still behind Europe, some U.S. politicians are pushing for blockchain exploration like Mick Mulvaney and Jared Polis, who announcedthe creation of a “Blockchain Caucus” last week. Europe has been more transparent, and fast moving on blockchain regulation, and in June released “The Distributed Ledger Technology Applied to Securities Markets” on the relevance of distributed ledger tech.

Takeaway

Blockchain regulatory conditions will improve as decision-makers, governing agencies, influencers and regulators understand the technology, and its tradeoffs. We expect Europe to lead the charge, and countries like Estonia (quickly becoming the fintech hotbed), with the United States to follow. Economist, Carlo Meijer analyses the intricacies of blockchain regulation in “Blockchain, Financial Regulatory Reporting and Challenges”.

4) Blockchain Talent

There is a shortage of blockchain talent: business folks, engineers, strategists, and individuals who understand blockchain technology adoption. In March, PwC, Deloitte, and KPMG announced their intent on hiring blockchain talent, but are realizing the talent shortage. Big banks like JPMorgan, BofA, Capital One are staffing up, andfeeling the pain as well. In August, we heard frustration from Japanese banks on attracting experts via Reuters. Hiring, attracting, and training blockchain talent is highly competitive, and organizations are paying up. One firm in the Northeast told us top blockchain talent could essentially, “name their salary”.

Takeaway

Hiring blockchain talent is hard (and expensive). There are only a couple hundred people in the world who truly understand the intricacies and implementation of blockchain technology, cryptocurrency, distributed ledgers, capital markets, existing systems and the many areas blockchain technology will touch. Expect universities to invest in curriculum and recruit professors over the next couple years, similar to the objectives of Cornell’s IC3 and MIT’s Media Lab Digital Currency Initiative.

Jerry Cuomo, IBM’s VP of blockchain, comments on blockchain’s current environment “at some level, the efficiency you get from blockchain is to create more of a B2B service without the friction. And many financial services companies are the friction in the system, by design.” At Converge, we have noticed this disconnect between startups and corporate objectives, and decision makers.

Entrepreneurs, consortia, BaaS providers, and corporate thought leaders are closing this gap and leveraging Cloud infrastructure and the ubiquitous compute power of today. This movement allows for an entirely new way of processing transactions: touching capital, data, and even applications. With two blockchain investments in Cambridge and NYC, we’re scanning the environment for more companies that will bridge existing infrastructure to this new frontier.

Until next time,

Ash & Maia

Ash Egan and Maia Heymann are early-stage tech investors at Converge Venture Partners, focused on providing capital and connections for b2b, emerging technology companies in the Northeast. Connect with us via twitter @ashaeganand @maiaheymann.